How Did Oticon Shake Up the Hearing Industry?

By choosing value over volume and excluding their new Intent line from managed care formularies, Oticon is setting a new standard. This strategic choice has far-reaching implications. It proves that exclusivity not only enhances the patient experience but also solidifies the financial foundation of private practices.

Hear me out.

To understand the significance of this decision, some background context is necessary. It all starts with the concept of managed care. There are a lot of players involved in the game, so try and keep up!

What is Managed Care?

Managed care is a health care delivery system DESIGNED to manage cost, utilization, and quality. It integrates the financing and delivery of health care services by employing mechanisms such as:

- Networked health care providers and facilities

- Negotiated price arrangements

- Oversight of health care utilization

I stress the word “designed” because often times an end product does not function as intended.

How Does Managed Care Achieve an Ideal Model?

In an effort to achieve a sustainable healthcare system that works for patients, providers, and payers, the managed care movement has several objectives.

Here are the most well-known:

- Cost Containment: Reduce healthcare costs through various mechanisms such as provider networks, negotiated fee schedules, and economic incentives for choosing cost-effective treatments.

- Efficient Service Delivery: Streamline administrative functions and healthcare delivery to reduce waste and improve service to patients.

- Access to Care: Ensure that members have appropriate access to health services, including preventive services, and specialist care when necessary.

- Utilization Management: Carefully monitor and manage the use of healthcare services to avoid unnecessary or redundant services, which can drive up costs.

- Patient Satisfaction: Increase the satisfaction of members with both the care they receive, and the service provided by the managed care organization.

How Do You Calculate Quality?

I’m a numbers person. I can calculate cost and utilization all day, but quality of patient care? How can one truly quantify the quality of healthcare provided? The closest I can come to measuring the quality of managed care is by comparing managed care patient outcomes to private pay patient outcomes in regards to hearing aid return rates and visit utilization. I’ll save those results for another post.

Now, let’s talk about Medicare Advantage since the key demographic of the hearing industry is inundated with advertising for Medicare Advantage plan options.

What is Medicare Advantage?

Medicare Advantage plans, also known as Medicare Part C, are considered a type of managed care. These plans are offered by private insurance companies that contract with the federal government to provide all the benefits included in Original Medicare (Part A and Part B) and offer additional services (or incentives in my opinion) such as:

- Prescription drug coverage (Part D)

- Dental

- Vision

- Hearing

- Wellness programs

- As of 2023, 65,636,490 Americans are enrolled in Medicare.

- More than 48% of Medicare beneficiaries have a Medicare Advantage plan in 2023

- 99% of Medicare Advantage plans offer some dental, hearing, fitness and/or vision benefits.

“The Medicare Advantage market is primarily made up of for-profit health plans. These plans account for 73.5 percent of all Medicare Advantage enrollment..”- Healthpayerintelligence.com

What are Third Party Administrators?

The managed care plan then contracts with a Third Party Administrator (TPA) to manage the hearing aid benefits achieve the government’s goal of “Cost Containment.”

Next, the TPA contracts with hearing care professionals to test, recommend, and fit hearing aids that are on the plan’s formulary, and provide a predetermined amount of follow-up care.

In return, the hearing care professional is paid a minimal fee. Payment is made 60+ days after the patient is fit with the hearing aids.

The provider fee is often not enough to cover business expenses. The private pay patients, who typically keep traditional Medicare absorb the cost of increased operational expenses.

Oh yeah, and if the patient returns the hearing aid within 60-days, the provider is not paid the fitting fee or compensated for their time invested.

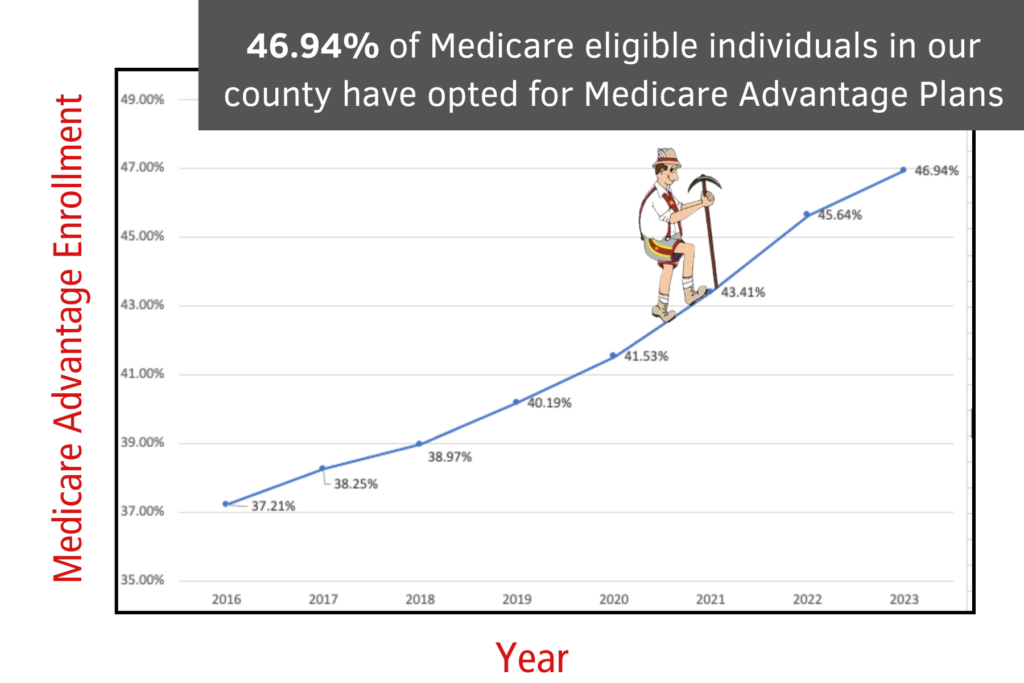

How Fast is Medicare Advantage Growing?

The managed care enrollment rate is steadily climbing year over year with no intention of slowing down.

There are 4.1 million Americans turning 65 each year.

The quantity of TPA devices dispensed annually in our clinics has increased at the same rate.

It is no longer financially feasible for hearing providers to participate with TPAs due to:

- Reductions in fitting fees

- Inability to compete with heavily discounted hearing aids due to the TPAs buying power

- Providing free follow-up care

- Deceptive marketing by managed care plans for free hearing aids

The goals of managed care are having the opposite effect on the hearing industry and are proving to be unsustainable.

‘Managed care’—a term that promised fiscal prudence—is ironically leading to:

- Increased overall costs

- Inefficient service delivery

- Limited access to hearing care follow up services

- Over-utilization of services with free entry level devices annually

- Patient dissatisfaction

Now that you are up to speed with the backstory, you can better understand how Oticon has shaken up the hearing industry which was either a very calculated move or just dumb luck.

Gary Rosenblum Says:

Choosing Value Over Volume

Oticon Rejected the Managed Care Model

By aligning its Intent hearing aids with private practices exclusively, Oticon has not just made a business decision; they have taken a stand for quality care. The result? An impressive boost in satisfaction and a dramatic uptick in revenue. The first month following Oticon’s decision resulted in our highest monthly gross revenue in 8-years.Oticon’s decision is a pivotal moment in audiology by challenging managed care’s dominance and underscoring the value of quality and patient-tailored care. It is a testament to the fact that TPAs need us more than we need them—a realization that could catalyze an industry-wide shift towards more sustainable, patient-focused business models.

Advocating for Exclusive Partnerships

As the tides shift, it’s imperative for audiology practices to reevaluate their product offerings and partnerships critically. Oticon’s approach should encourage other manufacturers to foster similar relationships with private practices that prioritize patient outcomes and operational independence over volume sales. Such partnerships can reinforce brand integrity and contribute to improved audiological healthcare outcomes.

Don’t Let Managed Care Managed You

The industry stands at a crossroads and the path you choose will define the future of your practice. Use this opportunity to reassess your business strategy. Reaffirm your commitment to providing patients with quality hearing aids and appropriate follow-up care while also nurturing the growth of your practice.

How has Oticon’s exclusivity of Intent affected your practice and your patients? Let us know in the comments!